Does Colorado Have Sales Tax On Services . colorado imposes sales tax on retail sales of tangible personal property. most goods and some services are subject to sales tax in colorado. In general, the tax does not apply to sales of services,. Colorado sales tax returns are. in colorado, you will be required to file and remit sales tax either monthly, quarterly or annually. This typically includes tangible personal property like furniture,. colorado collects sales tax on most goods and services sold in the state. while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. 443 rows colorado has state sales tax of 2.9%, and allows local governments to collect a local option sales tax of up to. The sales tax varies from county to. in colorado, sales tax is levied on the sale of tangible goods and some services.

from www.exemptform.com

colorado imposes sales tax on retail sales of tangible personal property. The sales tax varies from county to. 443 rows colorado has state sales tax of 2.9%, and allows local governments to collect a local option sales tax of up to. Colorado sales tax returns are. In general, the tax does not apply to sales of services,. colorado collects sales tax on most goods and services sold in the state. This typically includes tangible personal property like furniture,. in colorado, you will be required to file and remit sales tax either monthly, quarterly or annually. in colorado, sales tax is levied on the sale of tangible goods and some services. most goods and some services are subject to sales tax in colorado.

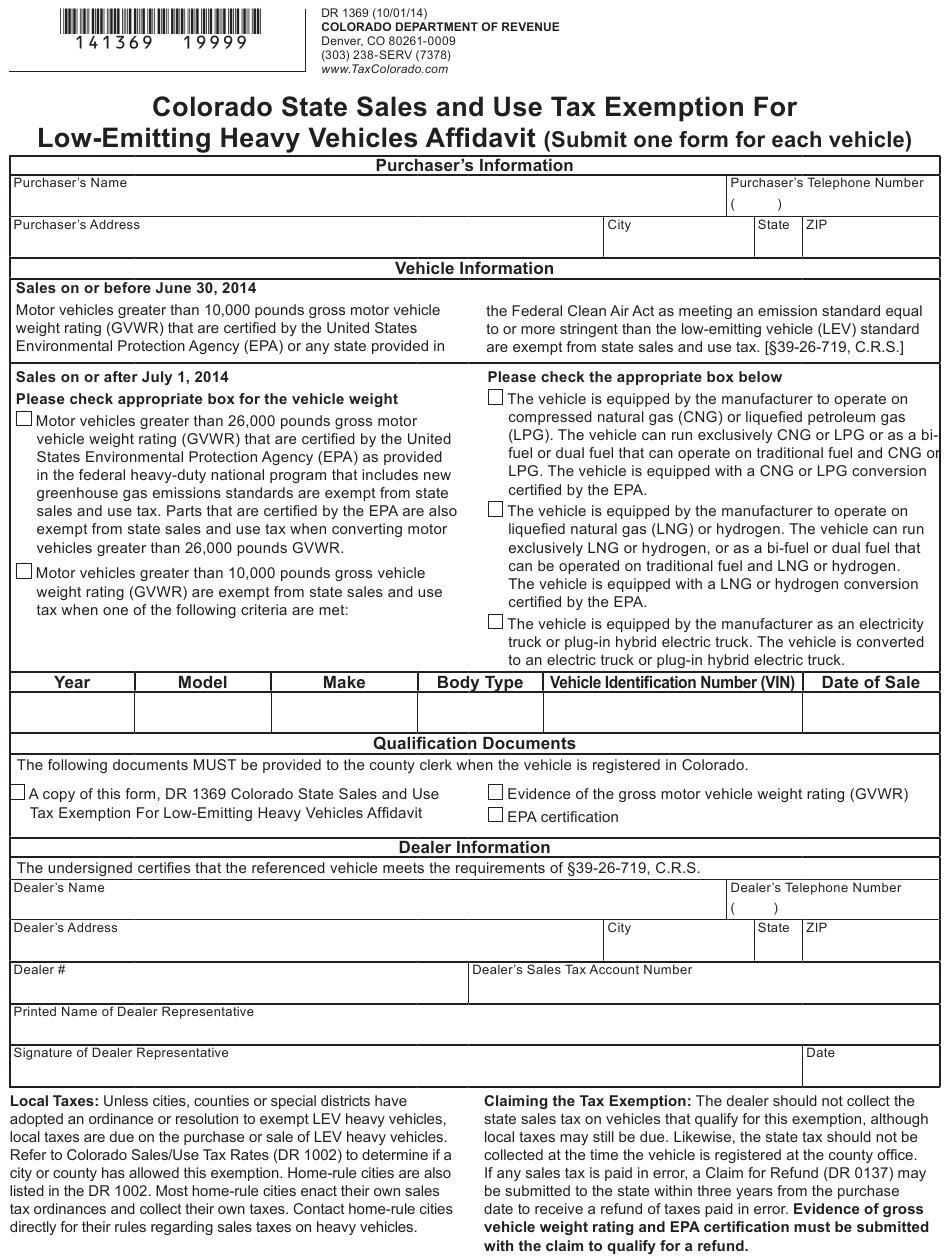

Colorado Sales And Use Tax Exemption Form

Does Colorado Have Sales Tax On Services 443 rows colorado has state sales tax of 2.9%, and allows local governments to collect a local option sales tax of up to. The sales tax varies from county to. Colorado sales tax returns are. while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. in colorado, sales tax is levied on the sale of tangible goods and some services. This typically includes tangible personal property like furniture,. colorado collects sales tax on most goods and services sold in the state. 443 rows colorado has state sales tax of 2.9%, and allows local governments to collect a local option sales tax of up to. most goods and some services are subject to sales tax in colorado. colorado imposes sales tax on retail sales of tangible personal property. in colorado, you will be required to file and remit sales tax either monthly, quarterly or annually. In general, the tax does not apply to sales of services,.

From www.formsbank.com

Sales Tax Return Form State Of Colorado printable pdf download Does Colorado Have Sales Tax On Services Colorado sales tax returns are. most goods and some services are subject to sales tax in colorado. colorado imposes sales tax on retail sales of tangible personal property. while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. This typically includes tangible personal property like furniture,. 443. Does Colorado Have Sales Tax On Services.

From www.exemptform.com

Colorado Sales And Use Tax Exemption Form Does Colorado Have Sales Tax On Services while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. most goods and some services are subject to sales tax in colorado. 443 rows colorado has state sales tax of 2.9%, and allows local governments to collect a local option sales tax of up to. This typically includes. Does Colorado Have Sales Tax On Services.

From www.youtube.com

Colorado Tax Sales Tax Liens YouTube Does Colorado Have Sales Tax On Services Colorado sales tax returns are. while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. This typically includes tangible personal property like furniture,. The sales tax varies from county to. colorado imposes sales tax on retail sales of tangible personal property. in colorado, you will be required to. Does Colorado Have Sales Tax On Services.

From www.formsbank.com

Fillable Form Dr 0100 Colorado Retail Sales Tax Return printable pdf Does Colorado Have Sales Tax On Services The sales tax varies from county to. colorado imposes sales tax on retail sales of tangible personal property. In general, the tax does not apply to sales of services,. most goods and some services are subject to sales tax in colorado. Colorado sales tax returns are. while colorado's sales tax generally applies to most transactions, certain items. Does Colorado Have Sales Tax On Services.

From thefitnesscpa.com

How Do I Register for a Colorado Sales Tax License When Starting a New Does Colorado Have Sales Tax On Services in colorado, sales tax is levied on the sale of tangible goods and some services. 443 rows colorado has state sales tax of 2.9%, and allows local governments to collect a local option sales tax of up to. most goods and some services are subject to sales tax in colorado. The sales tax varies from county to.. Does Colorado Have Sales Tax On Services.

From meyasity.blogspot.com

Colorado Department Of Revenue Online Payment Meyasity Does Colorado Have Sales Tax On Services most goods and some services are subject to sales tax in colorado. This typically includes tangible personal property like furniture,. colorado imposes sales tax on retail sales of tangible personal property. in colorado, you will be required to file and remit sales tax either monthly, quarterly or annually. 443 rows colorado has state sales tax of. Does Colorado Have Sales Tax On Services.

From www.way.com

Colorado Car Sales Tax A Comprehensive Guide Does Colorado Have Sales Tax On Services The sales tax varies from county to. 443 rows colorado has state sales tax of 2.9%, and allows local governments to collect a local option sales tax of up to. in colorado, you will be required to file and remit sales tax either monthly, quarterly or annually. in colorado, sales tax is levied on the sale of. Does Colorado Have Sales Tax On Services.

From taxfoundation.org

2021 Sales Tax Rates State & Local Sales Tax by State Tax Foundation Does Colorado Have Sales Tax On Services colorado imposes sales tax on retail sales of tangible personal property. colorado collects sales tax on most goods and services sold in the state. in colorado, you will be required to file and remit sales tax either monthly, quarterly or annually. The sales tax varies from county to. Colorado sales tax returns are. This typically includes tangible. Does Colorado Have Sales Tax On Services.

From www.patriotsoftware.com

Sales Tax Laws by State Ultimate Guide for Business Owners Does Colorado Have Sales Tax On Services Colorado sales tax returns are. in colorado, you will be required to file and remit sales tax either monthly, quarterly or annually. most goods and some services are subject to sales tax in colorado. This typically includes tangible personal property like furniture,. colorado imposes sales tax on retail sales of tangible personal property. colorado collects sales. Does Colorado Have Sales Tax On Services.

From www.templateroller.com

City of Boulder, Colorado Sales/Use Tax Return Form Fill Out, Sign Does Colorado Have Sales Tax On Services The sales tax varies from county to. 443 rows colorado has state sales tax of 2.9%, and allows local governments to collect a local option sales tax of up to. in colorado, you will be required to file and remit sales tax either monthly, quarterly or annually. colorado collects sales tax on most goods and services sold. Does Colorado Have Sales Tax On Services.

From www.gobankingrates.com

Sales Tax by State Here's How Much You're Really Paying GOBankingRates Does Colorado Have Sales Tax On Services This typically includes tangible personal property like furniture,. The sales tax varies from county to. Colorado sales tax returns are. In general, the tax does not apply to sales of services,. 443 rows colorado has state sales tax of 2.9%, and allows local governments to collect a local option sales tax of up to. most goods and some. Does Colorado Have Sales Tax On Services.

From webinarcare.com

How to Get Colorado Sales Tax Permit A Comprehensive Guide Does Colorado Have Sales Tax On Services in colorado, you will be required to file and remit sales tax either monthly, quarterly or annually. while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. colorado collects sales tax on most goods and services sold in the state. The sales tax varies from county to. . Does Colorado Have Sales Tax On Services.

From www.yumpu.com

2012 Pueblo and Colorado Sales Tax Exemption Certificate Rocky Does Colorado Have Sales Tax On Services 443 rows colorado has state sales tax of 2.9%, and allows local governments to collect a local option sales tax of up to. This typically includes tangible personal property like furniture,. in colorado, you will be required to file and remit sales tax either monthly, quarterly or annually. The sales tax varies from county to. in colorado,. Does Colorado Have Sales Tax On Services.

From www.sales-taxes.com

81052 Sales Tax Rate CO Sales Taxes By ZIP June 2024 Does Colorado Have Sales Tax On Services in colorado, you will be required to file and remit sales tax either monthly, quarterly or annually. In general, the tax does not apply to sales of services,. while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. Colorado sales tax returns are. This typically includes tangible personal property. Does Colorado Have Sales Tax On Services.

From statesalestaxtobitomo.blogspot.com

State Sales Tax Colorado State Sales Tax Rate Does Colorado Have Sales Tax On Services Colorado sales tax returns are. colorado imposes sales tax on retail sales of tangible personal property. in colorado, you will be required to file and remit sales tax either monthly, quarterly or annually. colorado collects sales tax on most goods and services sold in the state. This typically includes tangible personal property like furniture,. in colorado,. Does Colorado Have Sales Tax On Services.

From celleqmelosa.pages.dev

When Can You File Taxes 2024 Colorado State Casi Martie Does Colorado Have Sales Tax On Services colorado imposes sales tax on retail sales of tangible personal property. in colorado, sales tax is levied on the sale of tangible goods and some services. The sales tax varies from county to. in colorado, you will be required to file and remit sales tax either monthly, quarterly or annually. This typically includes tangible personal property like. Does Colorado Have Sales Tax On Services.

From www.templateroller.com

City of Lakewood, Colorado Sales and Use Tax Return Form Fill Out Does Colorado Have Sales Tax On Services The sales tax varies from county to. Colorado sales tax returns are. while colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it. colorado imposes sales tax on retail sales of tangible personal property. This typically includes tangible personal property like furniture,. 443 rows colorado has state sales tax. Does Colorado Have Sales Tax On Services.

From www.patriotsoftware.com

How to Pay Sales Tax for Small Business Guide + Chart Does Colorado Have Sales Tax On Services in colorado, sales tax is levied on the sale of tangible goods and some services. in colorado, you will be required to file and remit sales tax either monthly, quarterly or annually. colorado collects sales tax on most goods and services sold in the state. 443 rows colorado has state sales tax of 2.9%, and allows. Does Colorado Have Sales Tax On Services.